Tax resolution and legal representation to

get your life back

Serving taxpayers with the expertise of a large tax firm–with less financial burden and a greater capacity to serve well.

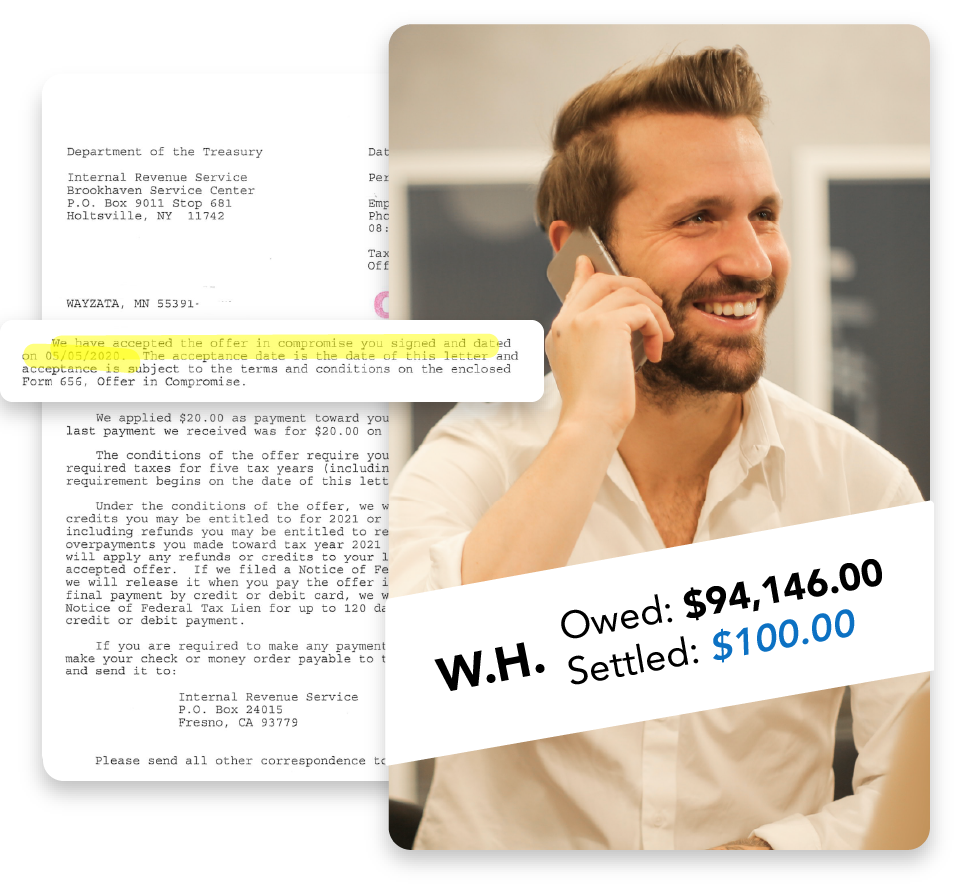

Dollar figures are actual results from real clients.

Photos of people are representational only.

Your #1 Resource for Tax Resolution & Legal Defense

Wildes At Law, LLC has partnered with CLAW Tax Group, giving you unprecedented access to a full range of tax resolution services and legal representation.

Tax Resolution and Tax Preparation

Helping taxpayers who haven’t filed their tax returns, haven’t paid their taxes or are being audited.- Offer in Compromise (OIC) – Settle your tax debt for considerably less

- Installment Agreements (IA) or Partial Pay – Pay a smaller amount each month

- Currently Not Collectible Status (CNC) – Temporarily delay attempts to collect your tax debt

- Penalty Abatement – Waive penalties for failure to pay or failure to file

- Tax Liens – Take back your real estate and personal property

- Bank Levies – Release the bank levy and reclaim your assets

- Withholding Lock Release – Get the hard-earned paycheck you deserve

- Filing Taxes & Back Taxes – Take the stress out of tax season–plus mitigate the fear and risk of getting audited

- Statute of Limitation Disputes – Watch your back to ensure the IRS collection period ends when it should

- Injured & Innocent Spouse Relief – Fight to get your share of refund released to you

- Exam & Audit Defense – Develop a defense strategy and stand before the IRS for you

- Process & Appeal Hearings – Fight for your rights and represent you in all IRS hearings

Legal and Accounting Services

Defending taxpayers and tax preparers against criminal prosecution and asset seizures.- Bankruptcy – Advise on options, prepare documents and represent you in bankruptcy court

- Business Formation – Start your business on a firm tax foundation

- Business Dissolution – Dissolve or withdraw your business properly to avoid tax problems later

- Business Domestication – Handle the complicated details of moving your company to a different state

- Transaction Structuring – Determine the best way to structure transactions to minimize tax consequences

- Wills & Trusts – Customize an estate plan that minimizes estate tax

- Claiming Tax Credits – Advise on how to get every dollar-for-dollar tax credit for your business

- Tax Preparer Malpractice Claims – Protect your business and reputation against allegations of negligence

- Tax Preparer Ethics Claims – Defend against OPR disciplinary actions

- Compliance Reviews for Tax Preparers or Firms – Review your tax compliance process to minimize risk and maximize tax savings

- Tax Preparer Penalty Defense – Appeal IRS penalties and request refunds for penalties assessed in error

- Criminal Defense for Tax Preparers – Secure a tax attorney intimately familiar with your side of the business

- Criminal Representation – Avoid a felony conviction for fraud or evasion

My husband and I can breathe again! Although we were making installment payments to the IRS on back taxes, the penalties and interest were accumulating faster than we could pay. In addition, I got cancer in the middle of the mess and that severely impacted our income, making payback impossible. Our advisor explained everything every step of the way and continues to answer questions we might have even [after] our Offer In Compromise was accepted by the IRS.

What’s Your Tax Problem?

I haven’t filed or paid my taxes

If you avoided filing taxes because you knew you couldn’t pay, it’s time to get your unfiled taxes in order and set up a payment plan with the IRS.

I’m being audited by the IRS

Never try to negotiate with the IRS or other tax authority on your own. You need the experience and insight of a Wildes At Law tax attorney on your side before you talk to an IRS auditor.

The IRS is threatening to seize my assets

When you fail to pay a tax debt, the IRS can seize your real estate and assets or freeze and seize your bank accounts. We will fight to defend your property and reclaim your assets.

I am being investigated for tax fraud

If the IRS is investigating you for tax evasion or tax fraud, they believe they have a good chance of convicting you. You need to contact Wildes At Law immediately to avoid large fines or even a prison sentence.

Request a FREE Consultation!

We’re Here to Help

Download CLAW Tax Group’s exclusive free tax relief resources, including our Guide to the IRS Collection Process and the Taxpayer Bill of Rights, 10 fundamental rights that every taxpayer should know about dealing with the IRS. Plus, check out our Tax FAQ’s, where you’ll find answers to frequently asked questions about tax relief services.

How CLAW Tax Group Can Help

Fight to protect your income and assets

At CLAW Tax Group, we are fiercely and fearlessly committed to keeping more money in your paycheck and your bank account, and out of the control of the IRS.

Stop harassing letters and phone calls

Activate your right to legal representation. CLAW Tax Group can take over all correspondence and conversations, so you can breathe again.

Significantly reduce the amount you owe

Let our Enrolled Agents and the Attorneys at our partner, Wildes At Law, LLC, negotiate an Offer in Compromise or work out a manageable payment agreement, so you can finally pay off your tax debt.

Secure the release of liens, levies and garnishments

Talk to CLAW Tax Group, and let us start the process to release levies and liens the IRS is holding against your bank accounts, business, home and property today.

Defend against criminal charges

An experienced, licensed bankruptcy lawyer from Wildes At Law, LLC, an exclusive CLAW Tax Group partner, can help you navigate your options, prepare legal documents for your case and represent you in court.

Advise and handle bankruptcy details

A bankruptcy lawyer from Wildes At Law, LLC, an exclusive CLAW Tax Group partner, can help you navigate your options, prepare legal documents for your case and represent you in court.

Get back on track with the IRS

Unpaid tax bills and unfiled tax returns inevitably lead to wage garnishments, tax liens and bank levies on your home or business. If left unmanaged long enough, your tax problems could end in bankruptcy or even criminal prosecution.

Tax problems can make you feel like life is spiraling out of control.

Take back control with help from Minnesota-based CLAW Tax Group. Our agents and attorneys are fiercely focused on helping you get out from under the burden of tax debt and back on track with the IRS.

Getting started is easy. Just fill out our simple form for your no-cost, no-obligation and completely confidential consultation.

Do NOT send confidential information such as SSN or bank account numbers using this form.

Real reviews from really satisfied clients

![]()

If a tax nightmare is keeping you awake at night, you’re not alone. No matter how you got into trouble with the IRS, CLAW Tax Group wants to help. Every customer’s situation is unique, but we are committed to fighting for your fresh start. Don’t let penalties and interest on your tax debt accumulate one more day without contacting us for help.

Dealing with the IRS is intimidating and can be frustrating but Matthew was reassuring and helped me with my case. The resolution was even better than I had hoped for. My case started right before Covid and this caused it to move much slower but Matthew stuck to it throughout and communicated updates whenever there was one. I hope to never need their services again but if I do, I would definitely trust them to resolve my issue.

A tax lien on my credit report was hindering prospective employers and qualifying for a home loan. Within 6 months the IRS accepted an offer of Compromise and 2 months later the Tax Lien was removed from my credit report! I am so grateful to Jon Call and his team for working on my behalf to put this Tax problem to rest and now I am able to qualify for a new home and work with a Company that fits me perfectly. Thank you for your hard work Jon and Team.

I owed $107,000 in back taxes due to my own mistakes. The IRS put leans on my property and froze my bank account. Within 2 days Jon had my accounts open again. He had my taxes reduces to $14,500. Jon stayed in touch with me and kept me informed on how everything was going. I can’t say enough about the help that I received. I have never had to deal with the IRS again. Thanks a million for all of your help!