Tax relief from A to Z

From filing back taxes to tax fraud defense, CLAW Tax Group has the help you need.

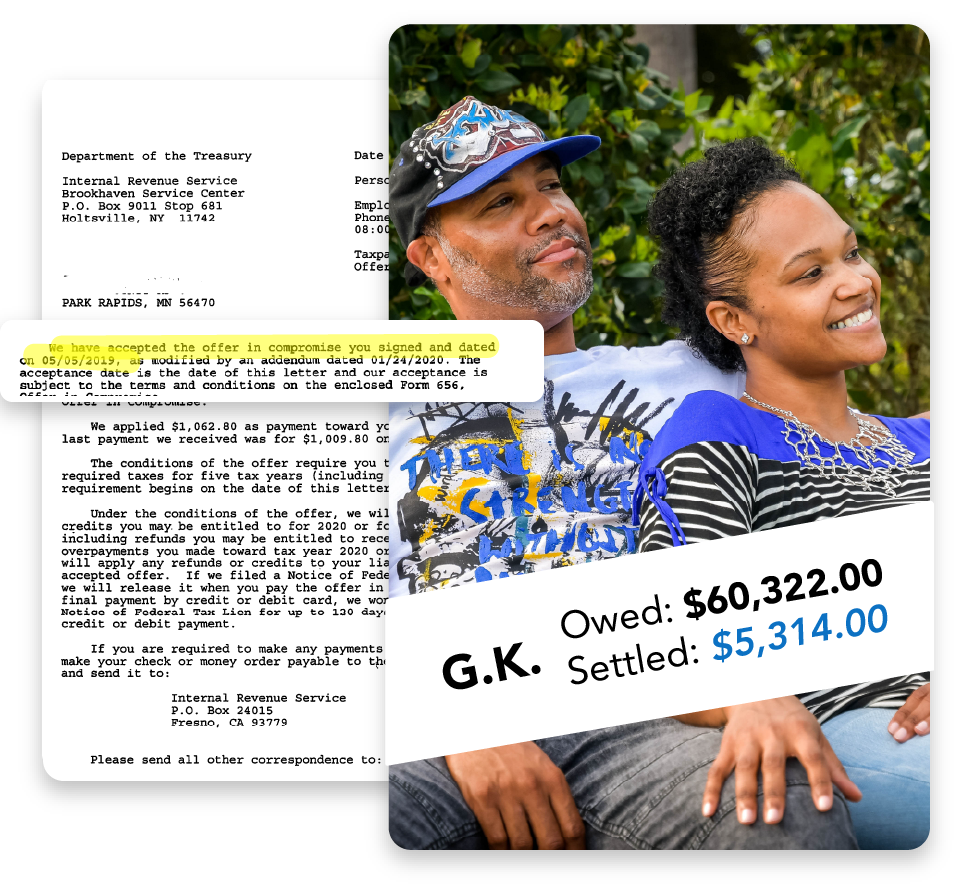

Dollar figures are actual results from real clients.

Photos of people are representational only.

Our Services

Tax Resolution and Tax Preparation

Offer in Compromise (OIC)

If the IRS believes there is little chance of recovering the full amount you owe, or that doing so would create a financial hardship for you, CLAW Tax Group can negotiate an Offer in Compromise with the IRS that would allow you to settle your tax debt for considerably less.

Installment Agreements (IA) or Partial Pay

If you can pay the full amount of taxes you owe, just not right now or not all at once, CLAW Tax Group can negotiate an IRS payment plan to give you more time to pay. A long-term payment plan, also known an Installment Agreement, or a Partial Pay Installment Agreement can be better than an Offer in Compromise.

Currently Not Collectible Status (CNC)

If you can barely afford to pay your basic living expenses, much less your tax debt, CLAW Tax Group can petition the IRS to grant you a Currently Not Collectible status. With a CNC status, the IRS will agree to cease all collection action for a set period of time or indefinitely.

If you can barely afford to pay your basic living expenses, much less your tax debt, CLAW Tax Group can petition the IRS to grant you a Currently Not Collectible status. With a CNC status, the IRS will agree to cease all collection action for a set period of time or indefinitely.

Penalty Abatement

If you have missed tax payments or filing deadlines due to uncontrollable circumstances, such as a death, serious illness or natural disaster, CLAW Tax Group can work to establish reasonable cause with the IRS to waive penalties for failure to pay or failure to file.

Tax Liens

When you fail to file your tax returns on time or pay your tax debt when it’s due, the IRS can seize your assets by enforcing a federal tax lien. If the IRS has filed a federal tax lien, CLAW Tax Group will fight to protect your real estate and other property through a lien release, withdrawal, subordination or discharge.

Bank Levies

If you let your outstanding tax debt go unpaid for too long, the IRS can seize your bank account. When the IRS contacts your bank to establish the levy, the bank immediately freezes your accounts and then turns over your assets to the IRS after 21 days. Let CLAW Tax Group negotiate with the IRS to release the bank levy and reclaim your assets.

Withholding Lock Release

If the IRS determines that too little federal withholding tax is being taken from your paycheck, they will direct your employer to withhold more and “lock in” that higher rate for at least three years. If a withholding lock has put a stranglehold on your paycheck, CLAW Tax Group will work to release the lock and make sure you get the hard-earned paycheck you deserve.

Filing Taxes & Back Taxes

Take the stress out of tax season–plus mitigate the fear and risk of getting audited–with professional tax preparation services from CLAW Tax Group. If you live in dread of unfiled tax returns from previous years, we’ll help you file your delinquent returns to get you caught up and compliant with the IRS.

Statute of Limitation Disputes

By law, the IRS has 10 years from the date of assessment to collect your tax debt. When you’re getting close to your Collection Statute Expiration Date (CSED), the IRS may suddenly become interested in offering you an OIC or other deal, which can actually extend their 10-year collection window. CLAW Tax Group will watch your back to ensure the IRS collection period ends when it should.

Injured & Innocent Spouse Relief

If you are divorced and believe you are not responsible for a tax liability your former spouse incorrectly reported without your knowledge, CLAW Tax Group can seek innocent spouse relief for you. If you filed jointly with your current spouse and the IRS is applying your share of a tax refund to your spouse’s past-due federal debts, CLAW Tax Group will fight to get your share of refund released to you.

Exam & Audit Defense

Tax attorneys, CPAs and the Enrolled Agents at CLAW Tax Group are legally authorized to represent you before the IRS during a tax audit or examination. Regardless of what triggered your audit notification, CLAW Tax Group will work with you to develop a defense strategy and then stand before the IRS for you.

Process & Appeal Hearings

You must act within 30 days to file a Collection Due Process (CDP) hearing request when you receive an IRS Notice of Intent to Levy or Notice of Federal Tax Lien. Likewise, you must work quickly to file an appeal if you believe the IRS is wrongly taking action against you or for the wrong amount. In either situation, CLAW Tax Group will fight for your rights, representing you in all IRS hearings.

Legal and Accounting Services

Bankruptcy

Get the best advice on bankruptcy options and an experienced advocate in bankruptcy court.

Business Formation

Build your business on a firm foundation from the start with professional tax planning services.

Business Dissolution

Finish well and avoid future tax problems with help from our partner, Wildes At Law, LLC, to properly dissolve or withdraw your business.

Business Domestication

Before you move your business to another state, enlist our partner, Wildes At Law, LLC, to handle the complicated details of your change of domicile.

Transaction Structuring

Contact a tax attorney at our partner, Wildes At Law, LLC, to discuss the best way to structure transactions to minimize tax consequences.

Wills & Trusts

Minimize estate tax with a custom and comprehensive estate plan that protects and provides for your loved ones.

Claiming Tax Credits

Get every dollar-for-dollar tax credit due your business with expert tax advice from our exclusive partner, Wildes At Law, LLC.

Tax Preparer Malpractice Claims

Secure a solid defense against allegations of negligence with representation in civil court by a tax attorney from our partner, Wildes At Law, LLC.

Tax Preparer Ethics Claims

Guard your tax preparer license against disciplinary actions by the OPR due to an ethics claim or investigation.

Compliance Reviews for Tax Preparers or Firms

Stay ahead of ever-changing tax compliance requirements, so you can minimize risk and maximize tax-saving opportunities.

Tax Preparer Penalty Defense

Enlist our partner, Wildes At Law, LLC, to appeal your IRS penalty for allegedly failing to follow tax laws and regulations.

Criminal Defense for Tax Preparers

Recruit a tax defense attorney from our partner, Wildes At Law, LLC, who will fight to protect you from a criminal conviction.

Criminal Representation

If you’re facing felony charges for tax fraud or evasion, trust a skilled tax attorney from our partner, Wildes At Law, LLC, to help you avoid a criminal conviction.

The IRS levied my bank account and my wages. In one day the levy was lifted. We have a very busy life and Jon was the most patient man I know. He worked so hard for us. He took all the stress out of our life as he assured us things would be okay and would get resolved in time. The Irs was not as prompt as we would have likes but the wait was worth it. Our 100,000.00+ tax debt was settled for 1,000.00. I owe my sanity and love of life again to Jon.

Maralee NG.

Get back on track with the IRS

Unpaid tax bills and unfiled tax returns inevitably lead to wage garnishments, tax liens and bank levies on your home or business. If left unmanaged long enough, your tax problems could end in bankruptcy or even criminal prosecution.

Tax problems can make you feel like life is spiraling out of control.

Take back control with help from Minnesota-based CLAW Tax Group. Our agents and attorneys are fiercely focused on helping you get out from under the burden of tax debt and back on track with the IRS.

Getting started is easy. Just fill out our simple form for your no-cost, no-obligation and completely confidential consultation.

Do NOT send confidential information such as SSN or bank account numbers using this form.

What to expect through the process

No tax resolution company can instantly make your IRS problems disappear. Anyone who promises to do so is simply lying to you.

So, what makes CLAW Tax Group different? We are highly self-accountable. We actively defend you against the IRS with aggressive legal representation while treating you with honesty, compassion and respect.

The first move is yours. Why not schedule your free consultation today?

Step 1

FREE CONSULTATION

During your free initial consultation, we’ll discuss your tax issues and financial situation. We’ll help you understand your options and give you an honest evaluation about whether we believe CLAW Tax Group can help you.

Step 2

PREPARATION & PLANNING

Once we’ve agreed that CLAW Tax Group is the right choice to resolve your tax problems, we’ll get to work right away. We will help you gather all the necessary information and will take over all communications with the IRS in your stead.

Step 3

SUCCESS

The majority of our clients receive favorable outcomes due to our diligence, expertise and unrelenting resolve. We will keep you informed throughout the entire process as we fight to protect your rights and achieve the best possible result for you.

Frequently asked questions

If you’ve got tax problems, you’ve got tax questions. We’re here to give you answers.

- Yes, your initial consultation with CLAW Tax Group is 100% free.

- Yes, we will give you an honest appraisal of your tax situation.

- No, you won’t pay a cent unless we truly believe we can help you.

Our Frequently Asked Questions page answers many of the tax relief questions we commonly hear. Need help fast? Call or text to (651) 323-2255. Get in touch now to set up your free consultation.

Is it possible to prevent the IRS from filing a tax lien?

Once the IRS has issued a Notice of Intent to file a federal tax lien, very little can be done to prevent the IRS from filing the lien. However, CLAW Tax Group can help you evaluate ways to release the federal tax lien after it has been filed at the local courthouse.