Tax resources to

empower and educate

CLAW Tax Group has information to get on your way to tax relief.

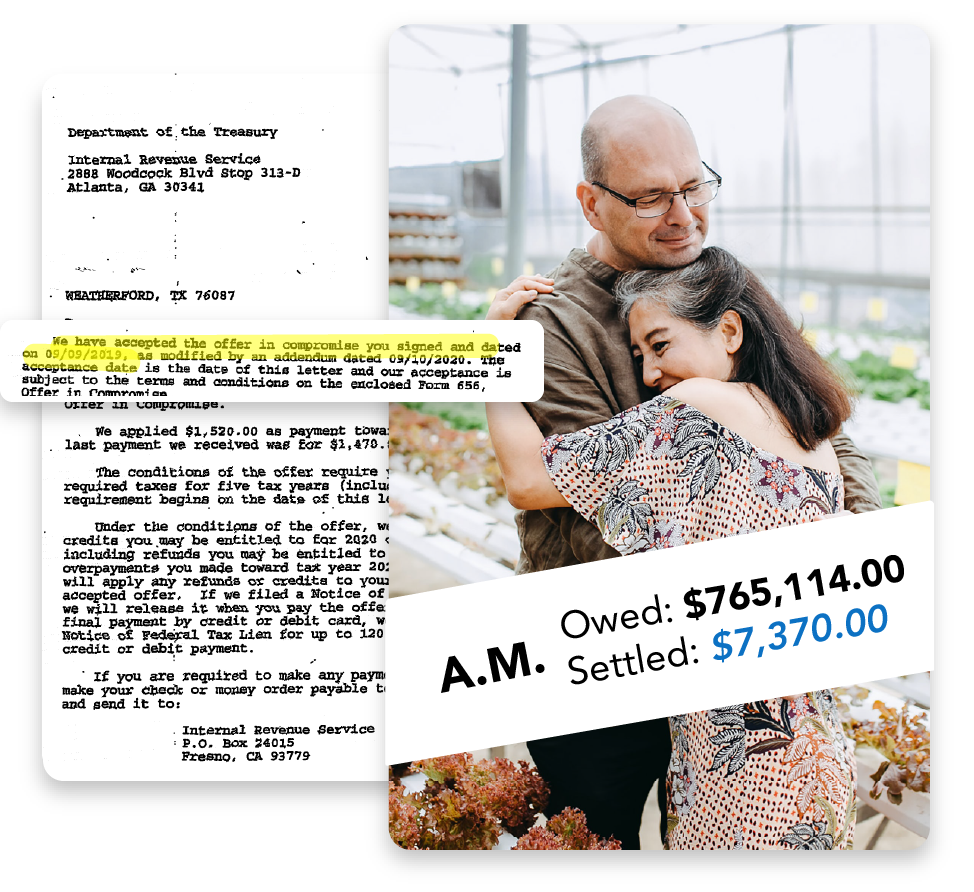

Dollar figures are actual results from real clients.

Photos of people are representational only.

Tax Resources

Get back on track with the IRS

Unpaid tax bills and unfiled tax returns inevitably lead to wage garnishments, tax liens and bank levies on your home or business. If left unmanaged long enough, your tax problems could end in bankruptcy or even criminal prosecution.

Tax problems can make you feel like life is spiraling out of control.

Take back control with help from Minnesota-based CLAW Tax Group. Our agents and attorneys are fiercely focused on helping you get out from under the burden of tax debt and back on track with the IRS.

Getting started is easy. Just fill out our simple form for your no-cost, no-obligation and completely confidential consultation.

Do NOT send confidential information such as SSN or bank account numbers using this form.

Frequently Asked Questions

If you’ve got tax problems, you’ve got tax questions. We’re here to give you answers.

Let’s start with these:

- Yes, your initial consultation with CLAW Tax Group is 100% free.

- Yes, we will give you an honest appraisal of your tax situation.

- No, you won’t pay a cent unless we truly believe we can help you.

Still have more questions? Take a look below at some commonly asked questions about tax relief, or go ahead and get in touch to set up your free consultation.

Questions about CLAW Tax Group

Where can I find a tax attorney near me?

If you're looking for a tax attorney near Minneapolis-Saint Paul, MN, great news! CLAW Tax Group has two offices in the Twin Cities area, one in White Bear Lake and another in Roseville.

Even if you're outside the Minneapolis area, our authorized tax advisors can still represent you before the IRS. In fact, we help clients across all 50 states and can handle most tax resolution services online via email or video calls and over the phone.

Experience and customer service far outweigh location. A simple online search for tax attorney near me can’t guarantee you’ll find a company dedicated to representing you with compassion, integrity and tenacity like CLAW Tax Group is.

Where is your office located?

North Saint Paul

4525 White Bear Pkwy

Suite 223

White Bear Lake, MN 55110

North Minneapolis/St. Paul

1915 Hwy 36W

Suite 4

Roseville, MN 55113

If you live out of state or prefer contactless meetings, we can handle most tax resolution cases online, by email and by phone. You can be sure we’re working hard to resolve your tax problems no matter where you are. Please feel free to call or text (651) 323-2255, or fill out our contact form to request your free consultation.

In-person appointments available on request.

How fast can you get started, and how long will it take to resolve my tax situation?

In most cases we start your case the same day of your free consultation, but the final closure of tax resolution cases depends heavily on the expediency of the IRS. The IRS is currently in a state of disrepair, causing cases to take longer to resolve. You can expect your case to take at least 4 months from start to finish, with most cases taking anywhere from 10 to 24 months to be completely resolved. Regardless of how long it takes, the sooner you contact CLAW Tax Group to get started, the sooner your IRS nightmare will be behind you.

How much do CLAW Tax Group's tax resolution services cost?

Two things you should know about paying for CLAW Tax Group’s services are that,

1) There will be no surprises on your bill thanks to our “flat and final” fee structure, and

2) You will not be charged anything if, in the course of your free consultation, we determine you would not realize a significant return on your investment with us.

Our “flat and final” fee structure means CLAW Tax Group customers typically pay less than what the big-name national tax relief firms charge. After your initial, free consultation, a CLAW Tax Group advisor will provide a quote for the cost of our legal services. These fees can range from $2,500 to $10,000+ depending on the scope and complexity of your case.

If a Research and Investigation case is required to better determine the scope of your tax problem, we will let you know up front. The Research and Investigation fee is between $500 to $1,000.

Get started for free today with a no-cost, no-obligation and completely confidential consultation.

How do I pay for CLAW Tax Group’s services?

We understand that most of our clients are facing difficult financial situations or even hardships. A majority of our clients pay the flat fee over the same period of time we’re working on their case. Some cases last 4 months, while others last 14 months. We will work with you to make the cost of legal representation affordable.

Start today for free with a no-cost, no-obligation consultation.

Do I Need a Tax Professional?

Do I really need a tax professional to represent me before the IRS?

Generally speaking, if you owe the IRS more than $10,000 or have unfiled tax returns, you’d be smart to chat with a knowledgeable tax representative before contacting the IRS. Although dealing with the IRS doesn’t require legal representation, Congress has granted taxpayers specific rights which include “the right to retain an authorized representative of their choice to represent them in their dealings with the IRS.” This is because even the politicians in Washington, D.C., know the IRS has the tendency to violate taxpayers’ rights. Most taxpayers don’t even know they have “due process rights,” let alone how to exercise them. Contact us today for a free consultation, and we’ll help you evaluate whether you need legal representation.

Can I resolve my tax liability on my own?

Taxpayers that try to resolve their tax liabilities on their own typically find themselves ill equipped to negotiate with IRS agents trained to take advantage of their inexperience. Without in-depth knowledge of IRS guidelines and tax codes, not to mention collection processes and standards, you’re left at the mercy of potentially unscrupulous IRS agents that will look out for the government’s best interests, not yours.

The CLAW Tax Group team of expert advisors has years of experience in negotiating with the IRS and won’t be intimidated by IRS threats or give in to unfavorable compromises. Turn the odds to your favor with our experienced, professional tax advisors who can cut through the confusion, stand up for your taxpayer rights and negotiate for the best possible resolution for your case.

Does the IRS forgive tax debt after 10 years?

The statute of limitations for the IRS to collect an outstanding tax debt is 10 years from the date the tax was assessed. However, it’s not so simple as to outwait the IRS until your tax debt is forgiven. The IRS typically won’t tell you when you are close to your Collection Statute Expiration Date, or CSED, and instead will ramp up their efforts–and aggressiveness–to collect as much money as possible from you as the CSED gets closer. There are also circumstances and events which can lengthen that 10-year period, such as filing for bankruptcy, applying for an OIC or other payment agreement, or living outside of the United States for six months or more. It is far wiser to contact a CLAW Tax Group representative who knows the ins and outs of tax law rather than risk making your situation worse by doing nothing.

Why should I hire a representative to defend me in an audit if I have nothing to hide?

The auditors are trying to assess the highest amount of taxes on you possible. We have seen countless times when a small assessment turned into a very large assessment, because someone was trying to handle an audit on their own. Bringing in counsel later can be more costly and time consuming because the representative will have to overcome the earlier mistakes made while someone was representing themselves.

Settling for Less than What's Owed

Does the IRS really settle taxes for less than the full amount owed?

Yes, under some circumstances the IRS will settle taxes for less than the full amount owed through their Offer in Compromise (OIC) program. Contact CLAW Tax Group today for a free consultation to see if you qualify.

How much do CLAW Tax Group's tax resolution clients typically save?

Based on actual results we’ve achieved for previous clients, you can expect to receive around a 95% discount on the federal tax debt you owe, assuming you are qualified to receive a settlement. Contact us for a free consultation to discuss whether your situation qualifies you for a tax debt settlement. And, we’ll proudly show you examples of our impressive real-world settlements.

What’s the average settlement amount for an Offer in Compromise?

Over the last decade, our average OIC settlement has been right around $1,000. Some settlements may be as low as $100, while others are much more. Most of our clients are able to pay off their settlement with the IRS in five months or less, but the IRS allows up to 24 months to pay an Offer in Compromise.

I think I’m qualified for an OIC, but “Offer in Compromise” sounds too good to be true. How can this be possible?

Only a very small portion of U.S. taxpayers are actually eligible for an Offer in Compromise. To qualify for an OIC, you must have been compliant for five years, so it’s not like the IRS is handing them out for nothing. The IRS wants to collect the full amount of money that you owe, and they will do everything in their power to seize any available income or assets you have until they’re paid in full. That said, the government needs you to actively participate in the economy, so, in rare instances–and after long and difficult negotiations–the IRS may be willing to forgive a portion of your debts through an Offer in Compromise agreement.

If I don’t qualify for an OIC, is there any other way to save money?

The best answer to this question is, maybe! You need to contact us to take advantage of your free consultation so we can better understand the unique circumstances of your situation.

- Penalty Abatement - The IRS does abate penalties if a taxpayer proves “reasonable cause.” This is a highly subjective process and your best chance for penalty abatement is through obtaining legal representation to petition on your behalf.

- Partial Payment Installment Agreement - The IRS might not accept an OIC but might accept a Partial Payment Installment Agreement instead. A PPIA allows a taxpayer to settle for less than they legally owe and pay a fixed amount over the statute of limitations.

- Economic Hardship - The IRS may not accept an OIC, but in some cases will not enforce collection. The IRS is legally prohibited from enforcing collection if doing so would create an economic hardship. If this is the case, you pay the IRS nothing, and the IRS agrees not to levy you.

Installment Agreements & Payment Arrangements

Can I pay the IRS in installments?

Depending on how much tax debt you owe, you may qualify for a short-term payment plan or a long-term installment agreement. A free consultation with CLAW Tax Group can help determine which IRS payment plan you may qualify for, and our tax advisors can help you apply for the appropriate plan.

I can't afford my current IA payments. Can I renegotiate my Installment Agreement?

Installment Agreements can be modified if you are able to provide justification for the modification. It is much better to get the agreement modified rather than to fail to meet the terms. If you default on an Installment Agreement, that is a black mark on your record and could be an issue for future relief.

I received a letter from the IRS with a demand to pay by a certain date. What should I do if I don’t have the money to pay by the deadline?

Ignoring IRS deadlines can have far-reaching negative consequences and cause irreparable financial harm. You should request your free consultation immediately to see how CLAW Tax Group can help.

I’ve been paying the IRS for years, and it seems like the balance never goes down. Is there anything I can do?

Yes! There are many nuances to consider when formulating a strategy to reduce your debt. While a settlement with the IRS provides a definitive conclusion, other, more pragmatic strategies may allow CLAW Tax Group to reduce your financial burden.

Liens, Levies & Wage Garnishments

What's the difference between a lien and a levy?

A federal tax lien is the government’s legal claim against your property when you neglect or fail to pay a tax debt.

An IRS levy is more serious and permits the legal seizure of your property to satisfy a tax debt. With a levy, the IRS actually takes your property and can sell it to recoup your debt.

Is it possible to prevent the IRS from filing a tax lien?

Once the IRS has issued a Notice of Intent to file a federal tax lien, very little can be done to prevent the IRS from filing the lien. However, CLAW Tax Group can help you evaluate ways to release the federal tax lien after it has been filed at the local courthouse.

The IRS is already actively garnishing my wages and/or levying my assets. What should I do?

You must contact CLAW Tax Group if the IRS is levying your assets or garnishing your wages. Take advantage of your free consultation to review your options and learn about your rights as a taxpayer.

Other Tax Questions

I received a letter saying I owe taxes, and I don't know why. Can CLAW Tax Group help?

An experienced tax attorney or other tax representative from CLAW Tax Group can conduct research and review your tax accounts to determine what is happening and what course of action needs to be taken to resolve your situation.

Can tax penalties and interest be waived?

Penalties and interest associated with back taxes can be substantial. While it is unlikely that interest will be waived, the IRS may abate or remove some or all of your penalties. To have your penalties removed you must establish reasonable cause as to why the return was late filed or paid late.

Can I dispute an audit or exam assessment after it has already been completed?

You can dispute an assessment as long as you still owe that balance or within two years of paying off that balance. Some situations will provide more legal rights to challenge than others, but the key will be to introduce substantially new evidence that was not presented at the original audit or exam.

Can I really be held responsible for my spouse's or former spouse's taxes?

By signing a joint tax return you are agreeing to be held with joint and several liability on any balances associated with that tax return. However, there may be relief available to you through Innocent Spouse or other remedies. Discuss your situation with CLAW Tax Group, and we can help determine if you qualify.

Can I be personally assessed business taxes even though it is an LLC?

Certain types of business taxes can be assessed on an owner or other responsible party even with LLC protection. These types of taxes include payroll, sales and use, withholding tax, and others. These taxes are considered paid by the consumer or employee, and failure to pay is theft by the business and responsible parties. Under certain circumstances CLAW Tax Group can successfully defend the personal assessment of these business taxes.