Tax resolution and legal representation to

get your life back

CLAW Tax specializes in helping taxpayers like you who haven’t filed their tax returns, haven’t paid their taxes or are being audited. From our Minnesota offices near Minneapolis-Saint Paul, we especially take pride in helping small business owners, entrepreneurs and independent contractors get out from under the burden of IRS collection and harassment.

Don’t put off talking to CLAW Tax one more day. Contact us today, and sleep better tonight.

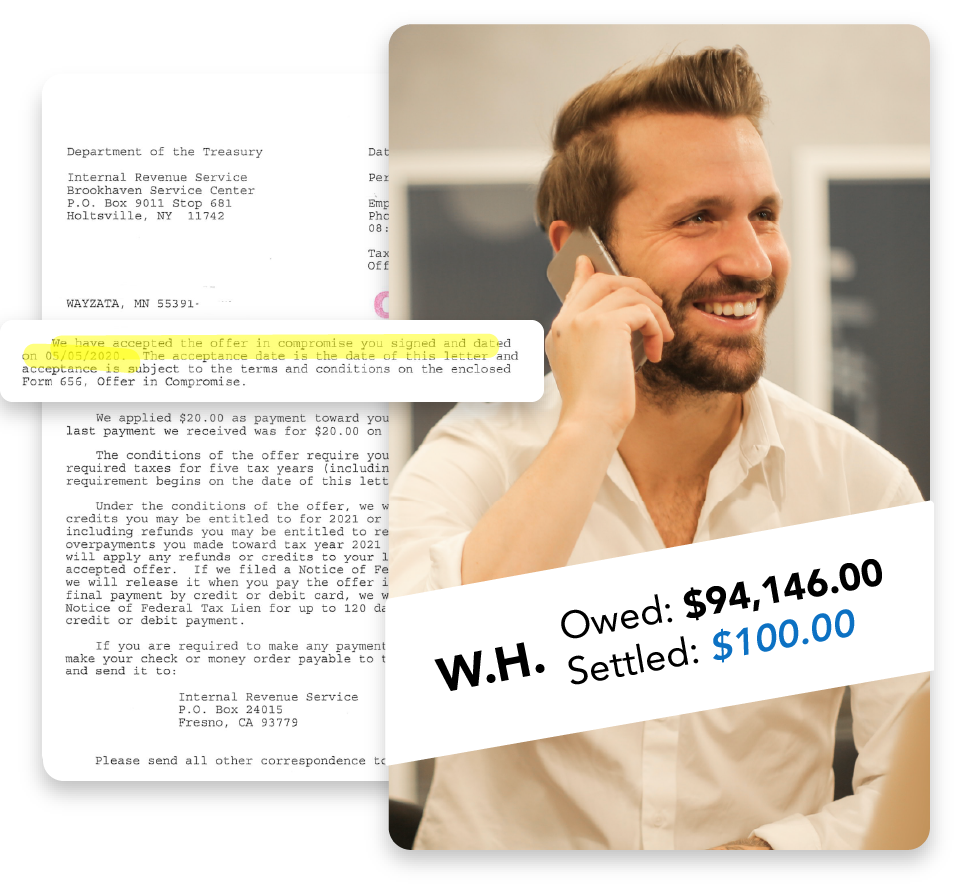

Dollar figures are actual results from real clients.

Photos of people are representational only.

What’s Your Tax Problem?

I haven’t filed my taxes

Figuring out when to pay and how to file taxes can be confusing, but unfiled tax returns can hinder you from buying a home or helping your college student apply for financial aid.

I haven’t paid my taxes

When it comes down to paying the federal government or keeping a roof over your family’s head, you know where your priorities lie. Now you need a reasonable settlement or payment plan.

I haven’t filed or paid my taxes

If you avoided filing taxes because you knew you couldn’t pay, it’s time to get your unfiled taxes in order and set up a payment plan with the IRS.

I’m being audited by the IRS

DO NOT go it alone against an IRS examiner whose job is to intimidate you into an unfavorable settlement. Fill out the form at right to contact CLAW Tax before you talk to an IRS auditor.

Request a FREE consultation!

We’re Here to Help

Download CLAW Tax’s exclusive free tax relief resources, including our Guide to the IRS Collection Process and the Taxpayer Bill of Rights, 10 fundamental rights that every taxpayer should know about dealing with the IRS. Plus, check out our Tax FAQ’s, where you’ll find answers to frequently asked questions about tax relief services.

How CLAW Tax Can Help

Fight to protect your income and assets

At CLAW Tax, we are fiercely and fearlessly committed to keeping more money in your paycheck and your bank account, and out of the control of the IRS.

Stop harassing letters and phone calls

Activate your right to legal representation. CLAW Tax can take over all correspondence and conversations, so you can breathe again.

Significantly reduce the amount you owe

Let our team of Attorneys and Enrolled Agents negotiate an Offer in Compromise or work out a manageable payment agreement so you can finally pay off your tax debt.

Secure the release of liens, levies and garnishments

Talk to CLAW Tax, and let us start the process to release levies and liens the IRS is holding against your bank accounts, business, home and property today.

Get back on track with the IRS

Unpaid tax bills and unfiled tax returns inevitably lead to wage garnishments, tax liens and bank levies on your home or business. These kinds of tax problems can make you feel like life is spiraling out of control.

Take back control with help from Minnesota-based CLAW Tax. We are fiercely focused on helping you get out from under the burden of tax debt and back on track with the IRS.

Getting started is easy. Just fill out our simple form for your no-cost, no-obligation and completely confidential consultation.

Do NOT send confidential information such as SSN or bank account numbers using this form.

Our Tax Resolution Services

Offer in Compromise (OIC)

Settle your tax debt for considerably less

Installment Agreements (IA)

Pay a smaller amount each month

Currently Not Collectible Status (CNC)

Temporarily delay attempts to collect your tax debt

Penalty Abatement

Waive penalties for failure to pay or failure to file

Tax Liens

Take back your real estate and personal property

Bank Levies

Release the bank levy and reclaim your assets

Withholding Lock Release

Get the hard-earned paycheck you deserve

Filing Taxes & Back Taxes

Take the stress out of tax season–plus mitigate the fear and risk of getting audited

Statute of Limitation Disputes

Watch your back to ensure the IRS collection period ends when it should

Injured & Innocent Spouse Relief

Fight to get your share of refund released to you

Exam & Audit Defense

Develop a defense strategy and stand before the IRS for you

Process & Appeal Hearings

Fight for your rights and represent you in all IRS hearings

Real reviews from really satisfied clients

![]()

If a tax nightmare is keeping you awake at night, you’re not alone. No matter how you got into trouble with the IRS, CLAW Tax wants to help. Every customer’s situation is unique, but we are committed to fighting for your fresh start. Don’t let penalties and interest on your tax debt accumulate one more day without contacting us for help.

My husband and I can breathe again! Although we were making installment payments to the IRS on back taxes, the penalties and interest were accumulating faster than we could pay. In addition, I got cancer in the middle of the mess and that severely impacted our income, making payback impossible. Our advisor explained everything every step of the way and continues to answer questions we might have even [after] our Offer In Compromise was accepted by the IRS.

A tax lien on my credit report was hindering prospective employers and qualifying for a home loan. Within 6 months the IRS accepted an offer of Compromise and 2 months later the Tax Lien was removed from my credit report! I am so grateful to Jon Call and his team for working on my behalf to put this Tax problem to rest and now I am able to qualify for a new home and work with a Company that fits me perfectly. Thank you for your hard work Jon and Team.

I owed $107,000 in back taxes due to my own mistakes. The IRS put leans on my property and froze my bank account. Within 2 days Jon had my accounts open again. He had my taxes reduces to $14,500. Jon stayed in touch with me and kept me informed on how everything was going. I can’t say enough about the help that I received. I have never had to deal with the IRS again. Thanks a million for all of your help!